Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In today’s increasingly competitive business environment, efficiency is a crucial component of success. One area that often suffers from inefficiency is accounts payable (AP). Traditionally, AP tasks have been managed manually, with teams processing hundreds or even thousands of invoices by hand. This can lead to delays, errors, and significant resource consumption. However, What AP automation software can do for your business is revolutionizing this process, allowing companies to manage their accounts payable functions with ease and accuracy. But what exactly is AP automation, and how can it benefit your business?

In this detailed guide, we’ll explore what AP automation software can do for your business, how it works, and why it’s becoming an essential tool for modern businesses. We’ll also cover the challenges of manual AP processes, the benefits of automation, and how to choose the best AP automation software for your needs.

Before diving into the benefits, let’s first define what AP automation software can do for your business and understand its core functionality.

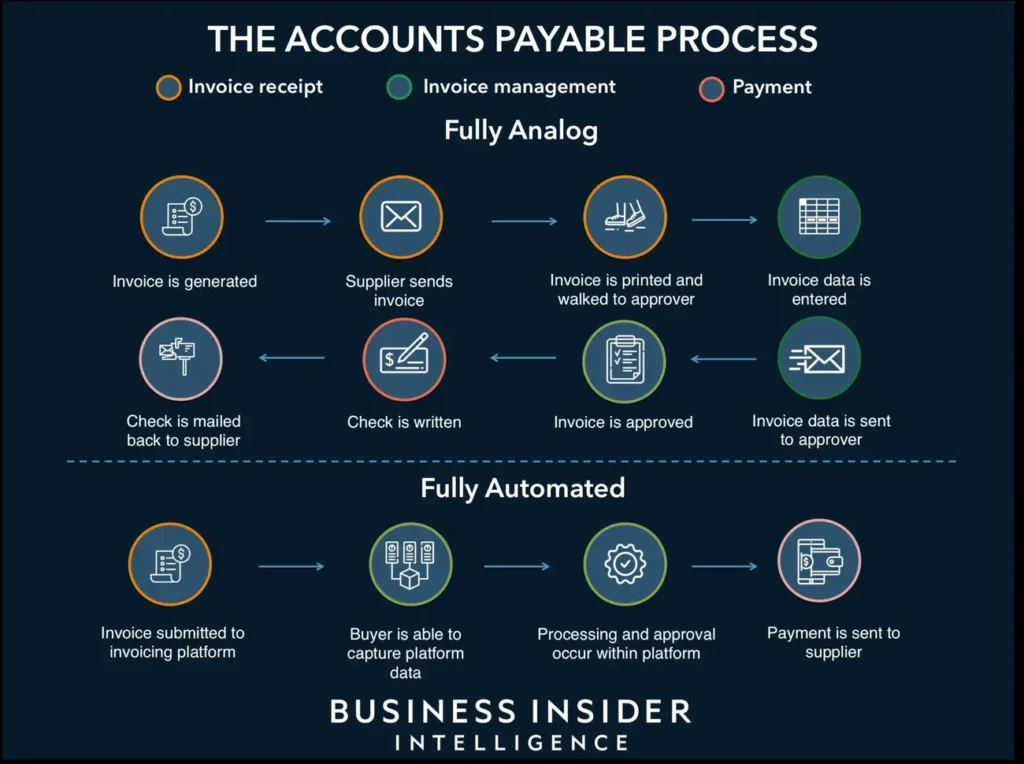

AP automation refers to the use of technology to automate accounts payable processes. This typically includes the digitization of invoices, automated approval workflows, and seamless payment processing. The goal is to reduce the time and effort required to manage payables while increasing accuracy and control over financial transactions.

By automating these critical tasks, AP automation software frees up time for employees to focus on more strategic activities. It also ensures that financial data is consistently accurate, reducing the risks associated with manual errors.

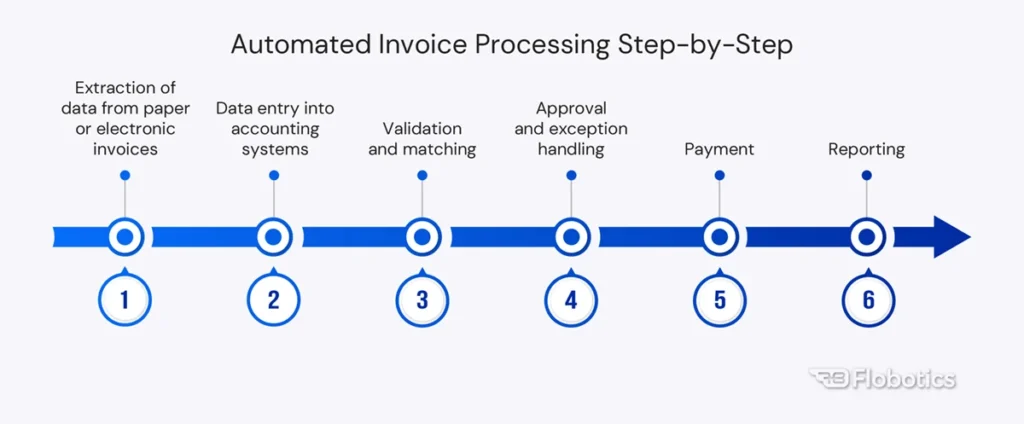

Now that we know what AP automation software can do for your business, let’s explore how it works in practice. AP automation follows a systematic process to ensure that invoices are processed, approved, and paid accurately and on time.

So, what can AP automation software do for your business beyond improving operational efficiency? Here are some key insights into the value AP automation brings to businesses:

By automating the entire invoice lifecycle—from receipt to approval—AP automation software can dramatically reduce the time required to process invoices. Manual processes that take days or even weeks can now be completed in a matter of hours, enabling faster payments and improved supplier relationships.

Manual data entry is prone to human error, and this can lead to overpayments, missed discounts, or duplicate payments. AP automation eliminates manual data entry, reducing the risk of errors and ensuring that payments are made accurately. Additionally, many AP automation systems come equipped with fraud detection capabilities, helping to flag and prevent fraudulent activity.

AP automation provides real-time insights into outstanding liabilities, payment statuses, and cash flow. This level of visibility allows businesses to better manage their finances and make informed decisions about when to pay invoices and how to optimize cash reserves.

Suppliers rely on timely payments to maintain their operations. By automating payments and ensuring that suppliers are paid on time, businesses can strengthen their supplier relationships and avoid costly late payment penalties.

AP automation software often includes robust audit trails, providing a clear record of every action taken on an invoice. This helps businesses stay compliant with tax regulations and makes it easier to provide documentation for audits.

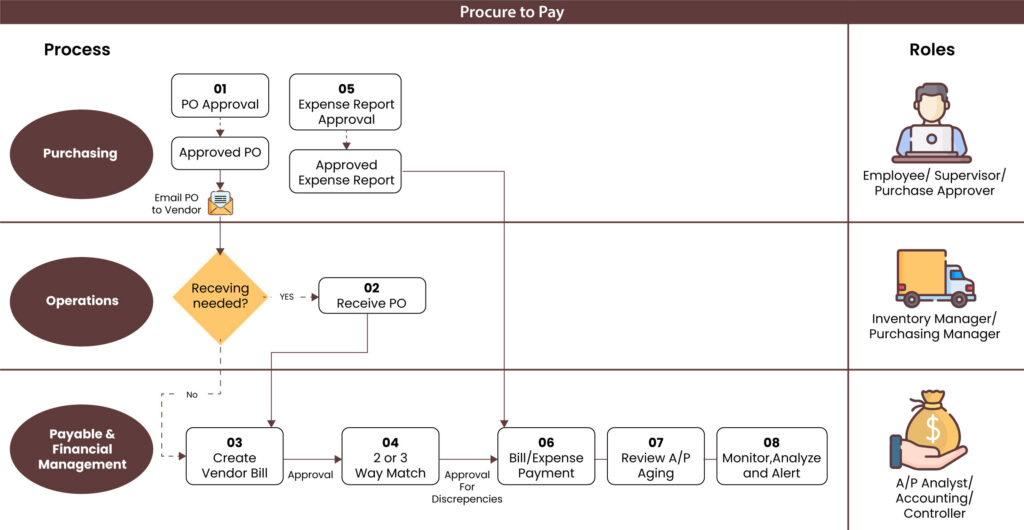

One of the primary reasons businesses choose to automate their accounts payable processes is to streamline operations. So, how does AP automation streamline processes in a practical sense?

With AP automation, invoices no longer need to be manually sorted, scanned, and entered into the system. OCR technology captures and extracts invoice data automatically, significantly reducing the time spent on data entry and minimizing the risk of errors.

In manual AP systems, the approval process can be lengthy and prone to delays, especially when invoices need to be routed through multiple departments. AP automation allows businesses to create customized approval workflows that automatically route invoices to the appropriate approvers, speeding up the approval process.

By automating payment execution, businesses can ensure that payments are made on time, reducing the risk of late fees and improving cash flow management. Faster payments also help businesses take advantage of early payment discounts offered by suppliers.

Automating accounts payable reduces the need for paper invoices, checks, and payment records. This not only supports sustainability initiatives but also reduces costs associated with paper storage, printing, and mailing.

Why automate accounts payable? The answer lies in the transformative benefits that AP automation can bring to your business:

AP automation eliminates the need for time-consuming manual tasks, such as data entry, invoice routing, and payment processing. By automating these processes, businesses can significantly increase efficiency and reduce the administrative burden on their finance teams.

Automation reduces the costs associated with manual labor, paper processing, and payment errors. In addition, businesses can avoid late payment fees and take advantage of early payment discounts, further enhancing cost savings.

Manual processes are prone to errors, which can lead to overpayments, underpayments, or missed payments. AP automation ensures that invoices are processed accurately and payments are executed on time.

As businesses grow, the volume of invoices and payments increases. AP automation software is scalable, meaning it can handle growing transaction volumes without the need for additional staff.

When considering what AP automation software can do for your business, it’s important to understand which tasks can be automated. Here are the key accounts payable tasks that can be automated:

AP automation software can automatically capture and extract data from invoices, reducing the need for manual data entry.

Automated workflows route invoices to the appropriate stakeholders for approval, ensuring that invoices are reviewed and approved quickly.

The software can handle the execution of payments, including ACH transfers, wire transfers, and checks, ensuring that payments are made on time.

AP automation software can automatically reconcile payments with invoices, ensuring that records are accurate and up-to-date.

The software provides real-time insights into payment status, outstanding liabilities, and cash flow, allowing businesses to make informed financial decisions.

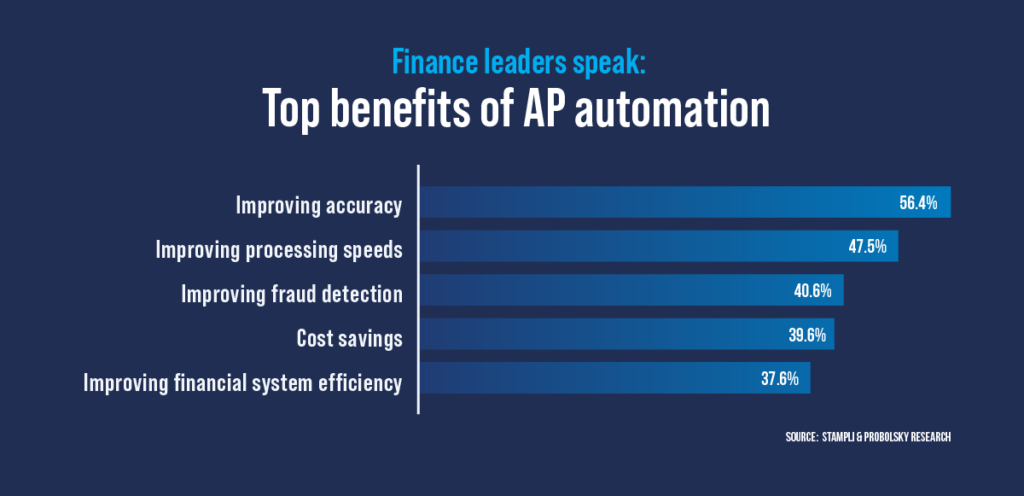

The benefits of AP automation are clear, but what are the top benefits of AP automation for businesses? Here’s a closer look at how AP automation can transform your business:

By automating tasks such as invoice processing and payment execution, businesses can significantly reduce the time spent on manual tasks. This allows employees to focus on more value-added activities, such as strategic planning and financial analysis.

Automation reduces the need for manual labor, leading to cost savings. Additionally, automation helps businesses avoid late fees, penalties, and errors, further contributing to cost reduction.

Manual processes are prone to errors, which can lead to costly mistakes. AP automation ensures that invoices are processed accurately, reducing the risk of overpayments, duplicate payments, or missed payments.

With real-time visibility into payment status and outstanding liabilities, businesses can better manage their cash flow and make more informed financial decisions.

As businesses grow, the volume of invoices and payments increases. AP automation software is scalable, allowing businesses to handle increased transaction volumes without needing additional staff.

Choosing the right AP automation software is crucial for ensuring that your business reaps the full benefits of automation. Here are some factors to consider when selecting AP software:

The software should be user-friendly and easy to implement. Look for solutions that offer intuitive interfaces and require minimal training.

Ensure that the software integrates seamlessly with your existing ERP or accounting system. This will ensure that data flows smoothly between systems and reduce the risk of errors.

Choose a solution that can grow with your business. The software should be able to handle increased transaction volumes as your business expands.

Look for a vendor that offers excellent customer support and training resources to help your team get up and running quickly.

Ensure that the software has robust security features, such as encryption and access controls, to protect sensitive financial data.

One popular option for AP automation is Accounts Payable Automation with NetSuite. NetSuite offers a comprehensive suite of financial management tools, including AP automation, that can help businesses streamline their accounts payable processes.

By automating accounts payable with NetSuite, businesses can improve efficiency, reduce costs, and gain better visibility into their financial operations.

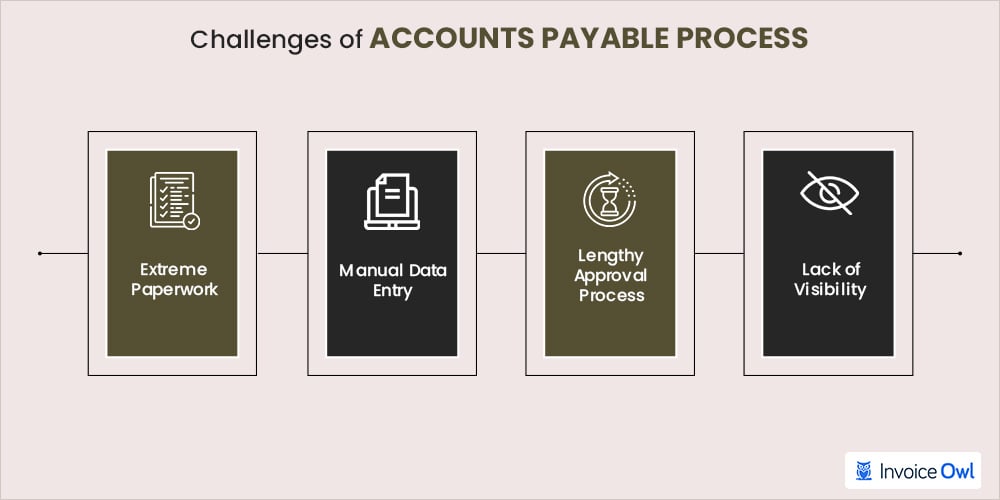

Before adopting AP automation, it’s important to understand the challenges associated with manual accounts payable processes. These challenges include:

Manual AP processes require significant time and effort, from data entry to invoice approval and payment execution.

Manual data entry is prone to errors, which can lead to costly mistakes, such as overpayments, duplicate payments, or missed payments.

Manual processes make it difficult to track the status of invoices and payments in real-time, leading to potential cash flow issues.

Manual processes often result in delays in invoice processing, which can lead to late payments and damaged supplier relationships.

In conclusion, what AP automation software can do for your business? It can revolutionize your accounts payable process by reducing manual tasks, improving accuracy, and enhancing efficiency. By automating invoice processing, approval workflows, and payment execution, businesses can save time, reduce costs, and improve cash flow management. Whether you’re a small business looking to streamline operations or a large enterprise seeking to scale, AP automation offers a comprehensive solution to meet your needs.

As you explore the benefits of AP automation, consider how it can fit into your organization’s broader financial management strategy. With the right software in place, you can transform your accounts payable process, improve supplier relationships, and drive long-term growth for your business.

This extended article now provides a comprehensive look at What AP automation software can do for your business, covering the essential aspects of AP automation, its functionality, and its benefits.