Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Canceling a life insurance policy is a significant decision, and it’s essential to understand the process thoroughly before proceeding. Whether you no longer need life insurance or have found a better option, knowing how to cancel American Income Life Insurance ensures you follow the correct steps, avoid penalties, and make a smooth transition.

This comprehensive guide provides everything you need to know about canceling your American Income Life Insurance (AIL) policy. From understanding why people cancel to comparing alternatives and knowing the necessary paperwork, we’ll cover it all.

Canceling American Income Life Insurance isn’t difficult, but it does require following specific steps to ensure that your cancellation is properly documented and completed without any issues. Here’s how to go about it:

The first thing you should do is review the terms and conditions of your insurance policy. This will give you crucial information about any penalties, fees, or waiting periods involved in canceling your policy. Some life insurance policies have specific clauses about early termination, and understanding these is vital.

Look for any details regarding:

Once you’ve reviewed your policy, the next step is to contact American Income Life (AIL) customer service. You can do this through:

When you contact them, ensure that you have your policy number and personal identification details ready to expedite the process.

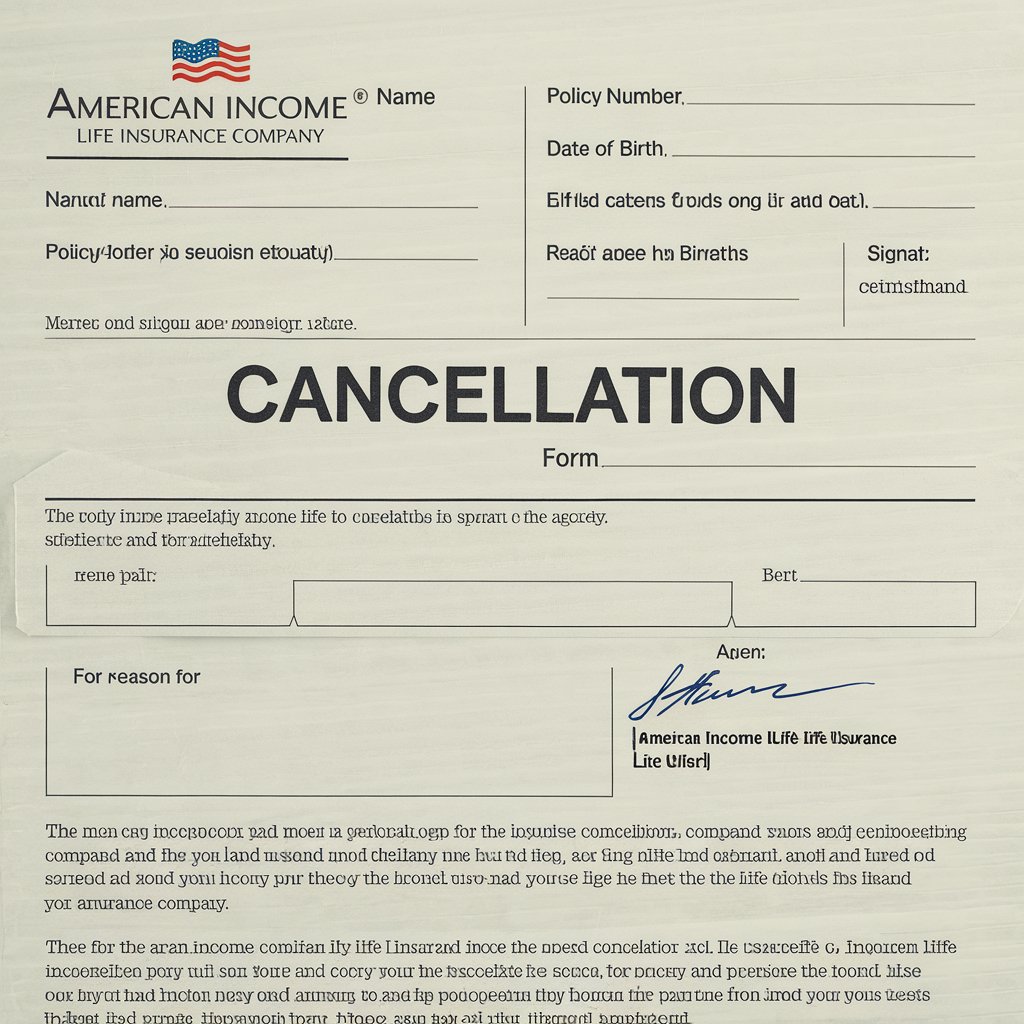

AIL typically requires you to fill out an American Income Life insurance cancellation form. This form is a formal request to cancel your policy and is necessary to document your cancellation.

The form may ask for the following information:

Make sure the form is completed accurately to avoid delays. If you’re unsure how to fill it out, customer service or your insurance agent can provide assistance.

Depending on the type of policy you hold, there may be fees associated with canceling your life insurance. These fees could include:

Before submitting your cancellation form, confirm if any fees apply and how to pay them. Keep a record of any payments made as part of your cancellation process.

After submitting the necessary forms and payments, ask for written confirmation from AIL that your policy has been canceled. This confirmation should state the effective date of the cancellation and any other relevant details, such as refund amounts or outstanding fees.

There are many reasons why individuals choose to cancel their life insurance policies. Here are some of the most common:

As life circumstances change, the need for life insurance may diminish. For example, if your children have grown up and are financially independent, or if you’ve paid off your mortgage, you might feel that you no longer need life insurance.

Many people cancel their American Income Life Insurance because they find better deals with other insurance providers. Life insurance companies are competitive, and switching providers can save you money on premiums or provide better coverage.

If paying for life insurance premiums becomes a financial burden, canceling your policy may seem like the only option. In some cases, reducing coverage or switching to a more affordable policy could be a better solution than canceling altogether.

Your financial goals may evolve, and the life insurance policy you initially purchased may no longer align with your needs. If your life insurance is part of a broader financial plan, and your financial situation has changed, canceling your policy might be a logical step.

You can contact American Income Life Insurance customer support in several ways:

Regardless of which method you choose, it’s essential to confirm that AIL has received your request and is processing it.

Before initiating the cancellation process, it’s important to gather the necessary documents. This will ensure a smooth cancellation without unnecessary delays:

Have your policy documents handy, including any amendments that may have been made. These documents will contain your policy number, coverage details, and the terms and conditions related to cancellation.

As mentioned earlier, most cancellations require you to fill out a specific cancellation form. You can get this form by contacting customer support or your agent. Be sure to fill out all fields accurately and submit it through the appropriate channels.

You may need to provide proof of identity when canceling your policy. Make sure you have a valid ID, such as a driver’s license or passport, available.

If there are outstanding payments or fees to be paid during the cancellation process, you’ll need your payment information readily available. You might need to settle these fees before your policy is officially canceled.

Yes, depending on the type of policy you hold and how long you’ve had it, there may be fees associated with canceling your American Income Life Insurance policy.

If you have a whole life or universal life policy, canceling it early may result in surrender charges. These charges compensate the insurance company for the lost potential income from your premiums.

In some cases, you may be required to pay administrative fees to cover the costs of processing your cancellation.

If you’ve prepaid your premiums or paid in advance for the year, you may be eligible for a partial refund of the unused premium amount. Be sure to clarify this with AIL customer support when canceling your policy.

Before you make the final decision to cancel your American Income Life Insurance, there are several considerations you should keep in mind:

Once you cancel your policy, you will no longer have the death benefit protection that your life insurance provided. If something were to happen, your beneficiaries wouldn’t receive the payout. Be sure to weigh this carefully, especially if you have dependents.

If you’re canceling AIL to switch to another provider, ensure that your new policy is active before canceling the old one. This will prevent any gaps in coverage, which could leave you uninsured for a period.

If your life insurance policy includes a cash value component, canceling it could have tax implications. The IRS may view part of the cash surrender value as taxable income. Consult a tax professional to understand how canceling your policy could impact your tax liability.

If canceling your life insurance policy isn’t the best solution, there are alternative options you can explore:

Rather than canceling your policy entirely, you can contact AIL to reduce your coverage. This will lower your premiums while still providing some protection for your loved ones.

If you currently have whole life or universal life insurance, converting your policy to a term life policy may be more affordable. Term policies typically offer lower premiums while providing coverage for a specific period.

In some cases, you may be able to sell your life insurance policy through a life settlement. This option allows you to receive a lump sum of cash while transferring ownership of the policy to a third party.

After canceling your American Income Life Insurance policy, it’s essential to compare other providers to ensure you’re getting the best coverage at the best price. Here’s how you can go about it:

Look at the coverage options offered by various providers. Are they offering similar coverage for a better price? Are there any riders or additional features that would be beneficial for you?

Compare the cost of premiums across different insurance providers. While it’s tempting to go for the lowest premium, ensure that the provider has a strong financial reputation and offers reliable coverage.

Read customer reviews and research the provider’s reputation. Pay attention to reviews about their customer service, claim process, and policy management. A company that is easy to work with can save you time and stress in the future.

Canceling life insurance is a significant decision, and it’s essential to assess your current and future needs before taking action:

If you have dependents such as children or a spouse, think carefully about how canceling your life insurance will impact them. Life insurance is a key tool in ensuring financial security for your loved ones after you pass away.

Do you have clear financial goals that align with your life insurance policy? If your policy no longer fits into your financial planning, consider either canceling or adjusting the coverage.

Yes, to cancel your American Income Life Insurance policy, you’ll need to submit an American Income Life insurance cancellation form. This form officially requests that your policy be terminated.

Ensure that the form is filled out accurately and submitted through the appropriate channels (customer service, email, or your agent). Follow up to confirm that the form has been received and is being processed.

To cancel your American Income Life Insurance policy without incurring penalties, follow these steps:

Review your policy for any penalty-free periods or clauses that allow you to cancel without fees.

Your agent may be able to offer alternatives or help reduce any penalties associated with early cancellation.

Rather than canceling, you could reduce your coverage or switch to a term policy, which might avoid penalties altogether.

To successfully cancel your American Income Life Insurance policy, follow these steps:

Canceling your life insurance policy is a major decision that requires careful thought. Be sure to weigh your current and future financial needs and explore all available options before proceeding with cancellation.